Quantum AI Kenya Hub

Discover AI-driven Stocks education features.

Access curated third-party course connections free. REGISTER NOW

Explore market education topics today

How many insights can market studies provide?

Enter the analysis timeframe you intend to follow and the engagement level you expect, and we will display your potential insights from educational market resources.

Join a network of the Quantum AI Kenya learning hub

In recent years, adoption of algorithmic approaches has shifted public interest and professional focus, complementing analysis of many traditional financial market data sources and research.

Key events in recent times highlighted algorithmic responses and discussion of market dynamics and participant behavior patterns. Consequently, examining computerized methods and algorithmic strategies alongside Stocks, Commodities, and Forex has grown into a central area of market analytical work. Structured resources can make accessing reliable analytical materials and applying systematic methods to market data more straightforward and consistent.

The Quantum AI Kenya service has been designed to deliver informational access and to connect users with independent third party global educational provider network. All materials remain strictly informational and awareness‑focused and concentrate exclusively on market concepts and conceptual frameworks. The Quantum AI Kenya offering provides curated resources and interactive elements that clarify algorithmic mechanics for both experienced practitioners and those new to market analysis. It serves both seasoned market analysts and newcomers by supplying structured sequences on chart interpretation and execution mechanics. By engaging introductory sequences and reviewing illustrated demonstrations with guided timelines, you can broaden market proficiency through structured educational exposure and concepts.

Discover algorithmic strategies and market education resources today

Try the Quantum AI Kenya resources for free today – view your projected insights

The Quantum AI Kenya offering enables users at all levels to develop market skills and conceptual understanding in digital asset contexts. You can review structured sequences that clarify scaling approaches and methods for parsing market data with transparency. The Quantum AI Kenya suite enables users to build awareness of market mechanics and apply conceptual frameworks across Stocks, Commodities, and Forex analysis.

How does Quantum AI Kenya site enable AI-driven market education?

The Quantum AI Kenya service is an informational resource that provides detailed explanatory material on market indicators, historical context, technological foundations, and market-related concepts for practitioners and researchers. Its value derives from curated collections, structured pathways, and reference materials that help clarify market dynamics, chart interpretation principles, and risk framework concepts using methodical, technology-driven and analytical presentation. Quantum AI Kenya connects users with independent third party educational providers and offers guided pathways, detailed readings, illustrative case studies, and demonstrations that examine currency topics alongside Stocks, Commodities, and Forex comparisons. All available materials are strictly informational and awareness-based, dedicated solely to market concepts and conceptual understanding, and they are presented in a neutral, factual, and compliance-focused manner to fully inform decision making. REGISTER NOW

Reasons to explore Quantum AI Kenya?

What educational advantages do market modules and coverage for Stocks, Commodities, and Forex with Quantum AI Kenya offer?

Develop Market Knowledge

A major advantage of engaging with Quantum AI Kenya research content is the accelerated deepening of market knowledge and expansion of practical awareness, with many learners reporting broader comprehension over time through independent third-party educational providers. All content is strictly educational and awareness-based only, serving as a dedicated resource for understanding market concepts rather than transaction execution or advisory services.

Immediate Access

Content becomes available following registration. The Quantum AI Kenya resource includes modules covering Stocks, Commodities, and Forex for study and awareness.

Ongoing Access

Self-paced market modules from Quantum AI Kenya are structured to enable progressive independent learning. Supplementary educational materials are available through independent third-party educational providers for personal study; access pertains to educational resources rather than service trials.

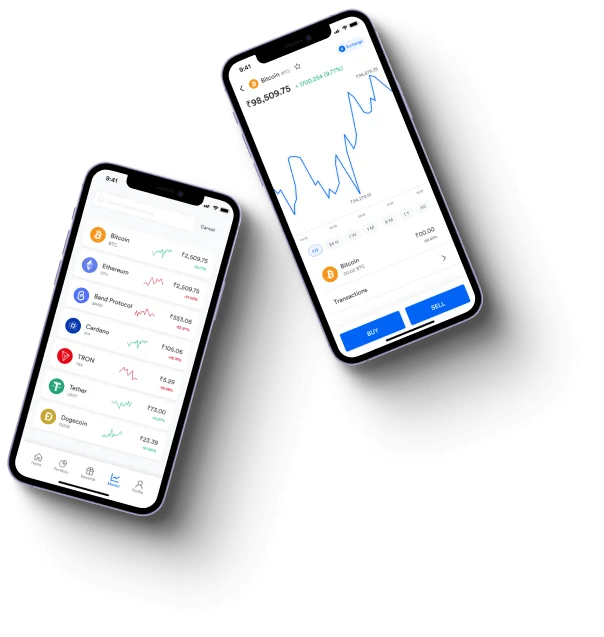

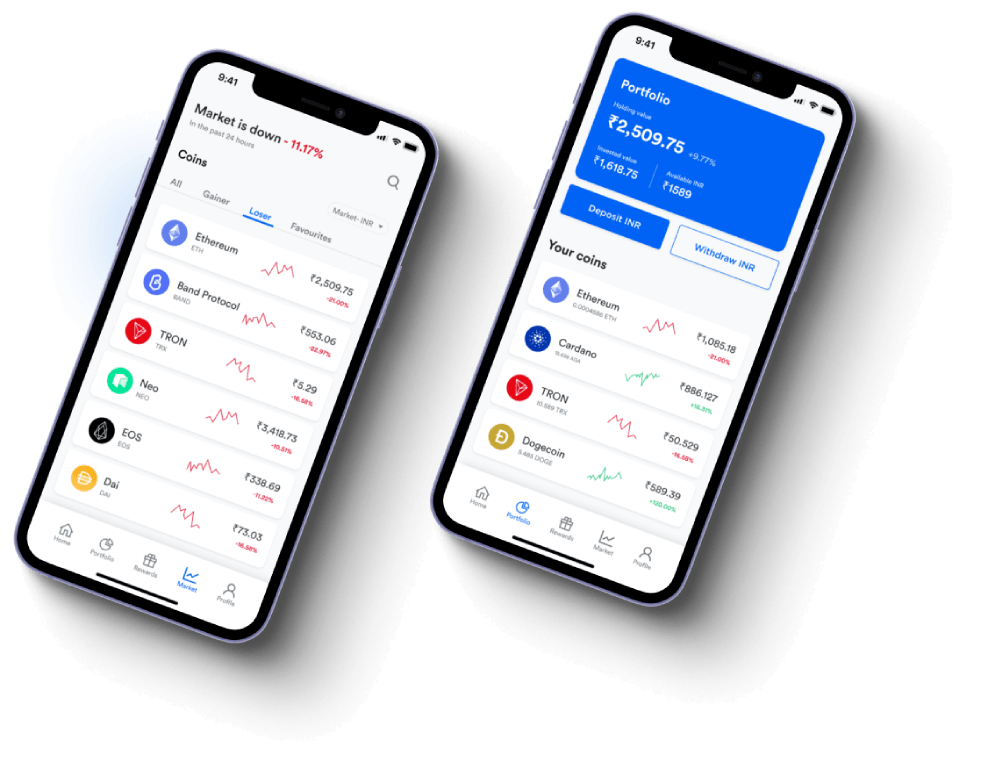

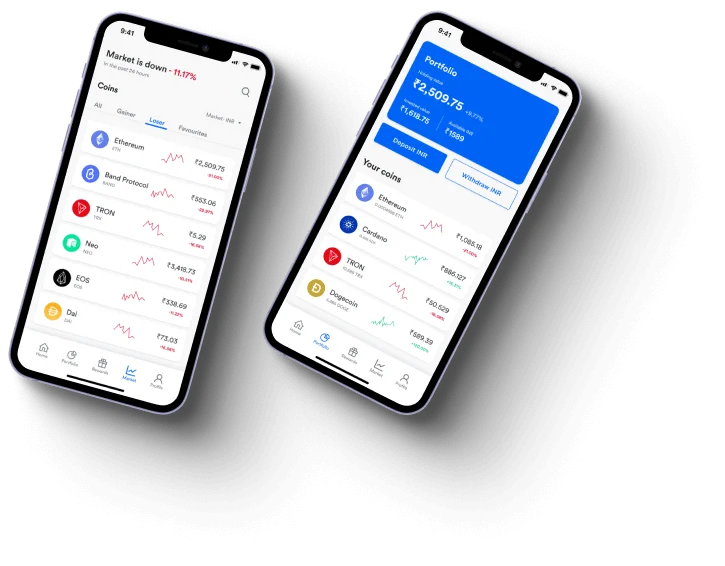

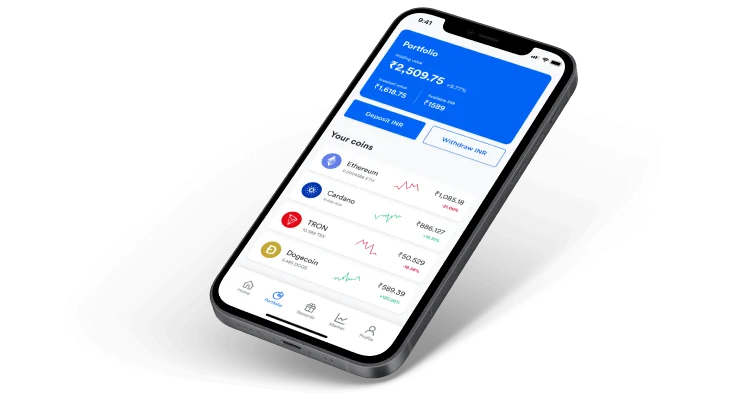

Mobile Access

The Quantum AI Kenya site delivers mobile-friendly access to AI-driven educational content and automated conceptual demonstrations for portfolio studies. This approach provides convenient flexibility for exploring market concepts and examining analytical materials at any time from any location.

Benefits from Quantum AI Kenya resources?

This is an excellent moment to explore the Quantum AI Kenya research community. Access currently remains complimentary, and availability could evolve over the coming months on a global basis. Furthermore, advances in data models and AI research are stimulating broad interest across market education domains. The Quantum AI Kenya team will publish updated access information in due course. Participants are encouraged to review resources promptly while current arrangements remain available.

The website functions as an informational reference and connects users to independent third-party educational providers. Coverage includes financial subjects such as Stocks, Commodities, and Forex for broad conceptual awareness. All materials provide technical context and are focused on market knowledge and conceptual insight for learners.

Access reference materials through Quantum AI Kenya. Prior market experience is optional for engagement with content. A modest time commitment supports review of technical modules and market summaries. Joining the research community is complimentary at present and designed for accessibility. Available connection routes and eligibility criteria are detailed on the informational pages. Register Now to explore the independent reference collections and expert-led materials. Community contributions and third-party content are presented for informational awareness and discussion. Registering interest is straightforward; use REGISTER NOW if you choose to access curated pathways.

Access global AI-powered educational resources for Stocks and Forex from anywhere

One of the core features of the Quantum AI Kenya website is delivering AI-powered educational content and automated conceptual demonstrations globally, with the site focused exclusively on informational materials and on connecting users to independent third-party educational and analytics providers that manage any operational offerings. An internet connection and a web browser are the basic requirements to access educational materials for Stocks, Commodities, and Forex on Quantum AI Kenya, with all content centered strictly on financial knowledge and awareness rather than advisory or direct market execution services.

Register to receive informational access to Quantum AI Kenya educational content and begin exploring features immediately. Joining the Quantum AI Kenya community is quick and straightforward. The website emphasizes product information, connects users to independent third-party educational and analytics providers, and presents all content as educational and awareness-based. Content covers financial education for Stocks, Commodities, and Forex to promote awareness and conceptual understanding.

Ways to access Quantum AI Kenya collections now

Visiting this website indicates you are ready to explore market education and begin engaging with conceptual resources. You are positioned to advance your knowledge and refine workflow understanding.

Registration with Quantum AI Kenya is streamlined and designed for informational access. Basic contact details are used to facilitate informational communications and community notifications. Following registration, email confirmation facilitates delivery of informational materials and access acknowledgements. This approach provides immediate informational access to Quantum AI Kenya content collections and enables exploration of educational materials and explanatory displays. Certain independent third-party integration modules may involve separate arrangements with external providers and adherence to their participation requirements. Such arrangements enable operational demonstrations and conceptual application opportunities managed by those external providers.

The advantages of the Quantum AI Kenya educational resource

The Quantum AI Kenya site provides users with educational resources, including:

Common information inquiries

1Which specific market topics and resources are covered when you use the Quantum AI Kenya service?

The Quantum AI Kenya service provides curated market resources and descriptive educational content. Content covers Stocks, Commodities and Forex, and links to trusted independent third-party analytics and educational providers.

2What typical time involvement is associated with the Quantum AI Kenya service?

Compared to general market research sources, Quantum AI Kenya presents an organized analytics hub with curated financial reference materials for every learner. A brief daily review of selected topics is sufficient to engage, and Quantum AI Kenya applies AI-enhanced educational curation and automated content sequencing thereafter. Learners may also explore and examine materials manually through the hub.

3What are the access and usage policies for the Quantum AI Kenya service?

Access to Quantum AI Kenya delivers informational reference resources and AI-enhanced educational curation. Access and registration are offered free of charge, and the informational offering includes connections to independent third-party educational providers alongside strictly educational content.

4Who is eligible to use the Quantum AI Kenya digital service?

The Quantum AI Kenya digital service welcomes users and industry contributors worldwide. It suits both experienced and beginning learners as prior experience is optional when exploring educational content on Stocks, Commodities and Forex, delivered through curated analytics and AI-enhanced sequencing.

5Are deposits required to access reference resources?

Any funding details are outlined during registration, and completion of the registration process enables digital access to Quantum AI Kenya reference materials immediately.

6How does the Quantum AI Kenya service sustain operations?

Quantum AI Kenya operates as an informational reference service delivering market analysis and connecting users to global independent third-party educational providers. By offering curated analytics and market insights, users gain conceptual awareness of price dynamics and market structure through educational content and AI-enhanced delivery.

Register Now

This website provides informational content about market indicators and financial concepts and foundations.

Reasons to explore Quantum AI Kenya?

Highly accurate insights

Market participants and analysts worldwide use Quantum AI Kenya to access AI-driven educational content and curated independent third-party providers that enhance understanding of Stocks, Commodities, and Forex markets efficiently. All site offerings remain informational and centered on financial knowledge and awareness, with third-party providers delivering educational curricula rather than advisory or execution services.

Advanced methodologies

The Quantum AI Kenya technical briefs apply model-based analysis to explain directional movement concepts across currency and market examples with concise timing comparisons to common research references. The resulting clarity from these resources supports consistent framing for users who access independent third-party educational research vendors.

Recognized resource

Quantum AI Kenya has received several recognitions due to its distinct and reliable AI-driven educational offerings. It is acknowledged within the market research community as a trusted and effective educational resource that delivers learning materials rather than downloadable programs or execution interfaces.

Market Concepts Core Framework

Quantum AI Kenya education hubs evolved as venues for issuing market educational credentials over decades, and they were early coordinated centers for sharing standardized learning records. In recent years, interest in voluntary market education has grown among course creators, institutional learners, and registry operators. These resources serve diverse participants globally and facilitate substantial knowledge transfers. To engage with offerings confidently, stakeholders should grasp course specifications and the instructional protocols that underpin certification.

Learning registries and credential clearing arrangements rely on infrastructure like centralized ledgers and reconciled recordkeeping. A master ledger logs issuances and expirations, preserving an auditable timeline of credential activity. Such records capture the sequence of all transfers since each registry began operations. Market participants, including algorithmic methods and AI-enabled research, verify and process entries to ensure provenance and governance.

Designated custodians are responsible for producing continuous credential records by reconciling submissions and updating the central ledger. In this workflow, they validate and record credits according to prescribed clearing practices. After finalization, entries are appended to registry archives and credential metadata is incorporated into distributed public records for reference.

These educational networks interconnect and information circulates across national and digital registries. This resource supplies operational and procedural information for market education and is informational only. The resource connects stakeholders to independent third-party educational providers. Content addresses registry operation topics including Stocks, Commodities, and Forex, benchmarks, and compliance.

Commodities Provide Solid Diversification Context For Institutional And portfolio allocation

Although flagship equity issues are often the most visible, there are many other market segments that have attracted the attention of industry experts and market participants globally. This website is informational only, links users to independent third-party educational providers, covers market topics including Stocks, Commodities, and Forex, and highlights AI-driven analytics and automated algorithmic approaches in a manner focused on market context and conceptual awareness; all content remains educational and awareness-based, centered strictly on financial knowledge, and financial and investment advice, advisory services, operational execution, and technical access are matters for independent third-party educational providers:

Gold (XAU)

Gold has long served as a foundational store of value across global markets. Numerous market analysts regard gold as maintaining enduring relevance due to its scarcity, cultural demand, and monetary uses. Its roles span jewelry, reserve holdings, industrial uses, and monetary functions.

Ongoing mining activity and refiners collaborate with financial institutions and commodity handlers to facilitate distribution and market access. Logistics, storage, and certification arrangements contribute to consistent custody and transport practices across jurisdictions. The site provides informational resources and connects users to independent third-party educational providers covering Stocks, Commodities, and Forex, and is dedicated to awareness-based conceptual market education; all content centers strictly on financial knowledge and conceptual understanding rather than market execution, advisory services, interactive product provision, temporary demonstrations, credentialed access, or personal onboarding.

Silver (XAG)

The website is informational and product-focused only, providing AI-powered analytical content and automated educational modules as a leading resource for market learners globally. It connects users to independent third-party educational providers and reputable data sources. Content covers financial data domains including stocks, commodities, and forex, primarily fundamentals for conceptual analysis. All material is strictly educational and awareness-based, centered on financial knowledge and market concepts, providing educational context rather than financial recommendations, guidance on market activity, asset allocation, operational execution, demonstrations, or advisory services.

Market Modules (MM)

Established as a technical resource, automated educational modules have long influenced research workflow design. Developed by quants and market analysts, AI-powered analytical content clarifies macroeconomic drivers, technical principles, risk concepts, and market structure while enhancing conceptual workflows for learners and developers alike. It offers comparative perspectives and technical references for theoretical market study and conceptual frameworks.

InfoFlow (Commodities)

The portal provides informational market content and reference material, while execution of transactions remains external. It connects users to independent third-party educational providers, coordinating trial and demo access through them. Content addresses financial markets including Stocks, Commodities, and Forex, providing informational perspectives separate from advisory services widely. All material is educational, awareness-based, emphasizing market fundamentals, analytical frameworks while related technologies remain independent.

Structured Courses (SAC)

Structured learning modules are instructional resources that illustrate features of contemporary educational infrastructure. They provide conceptual market exposure and aid comprehension for commodity subject matter. Content providers supply materials using standardized formats and rigorous assessment frameworks. The documentation focuses on course structure and integration, connects users to independent third-party educational providers, highlights Stocks, Commodities and Forex subject coverage, and emphasizes AI-enhanced learning resources alongside risk awareness, oversight mechanisms, and clear operational transparency. The website serves as an informational resource, delivering only educational and awareness-based content centered strictly on financial knowledge and market concepts, and remains distinct from advisory, operational access, or transaction execution services.

Why you may explore equity research with AI-powered analytical insights on stocks

The website offers analytical, technical, and awareness-oriented content. It connects users to independent, trusted third-party educational providers and data. Content covers technical and market topics including quantitative models, algorithmic research, AI-enhanced analytics, and data visualization. Examples include:

These factors have driven increased interest in resilient market frameworks worldwide. To support conceptual resilience, organizations employ analytics, AI-enhanced analytics, and monitoring practices. Equities, commodities, and foreign exchange markets present diverse historical behavior profiles and technical modeling approaches. Market comprehension supports informed conceptual decisions and awareness. These areas provide material for broader market knowledge:

This website provides technical material on quantitative models and digital market infrastructure and connects users to independent third-party educational providers via Quantum AI Kenya. All content is educational and awareness-based, centered on Stocks, Commodities, and Forex, and organized to build conceptual market knowledge separate from practical execution.